home

blog

sorooshx-weekly-updates

SorooshX...SorooshX Weekly Update (April 7th-13th): Market Insights and Platform Enhancements

Key Factors:

US-China Trade Developments: A significant shift occurred in the US-China trade war as the US Customs and Border Patrol announced exemptions for certain tech products, including smartphones and computers, from reciprocal tariffs. This news boosted market sentiment and risk appetite, contributing to a rally in Bitcoin prices.

Tariff Impact on Markets: Initially, tariffs imposed by the US caused declines in both stock and crypto markets. However, a subsequent 90-day pause on new tariffs led to a recovery, with Bitcoin stabilizing around $82,000 by the end of the week.

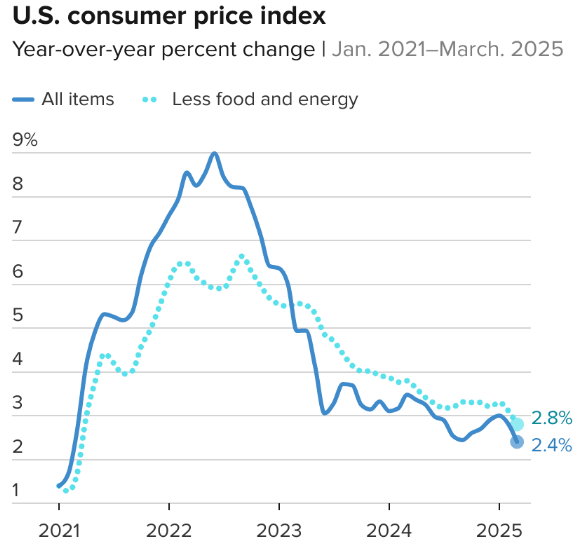

Macroeconomic Indicators: The Consumer Price Index (CPI) data for March came in lower than expected, which raised hopes for potential Federal Reserve rate cuts in the coming months. This economic backdrop is seen as favorable for risk assets, including cryptocurrencies.

Crypto tips:

Bitcoin Price Movements: Bitcoin (BTC) experienced significant volatility, hitting a low of 75,000beforerecoveringtoaround75,000 before recovering to around 75,000beforerecoveringtoaround85,379 by April 12. The price increase was attributed to easing tariff tensions and increased whale activity, with large holders accumulating BTC.

- Whale Activity: Data indicated that Bitcoin whales (addresses holding between 1,000 to 10,000 BTC) resumed accumulation, signaling confidence in the asset's price stability. This activity is often viewed as a bullish indicator for Bitcoin's future price movements.

Regulatory Changes: Paul Atkins was confirmed as the new SEC chair, and the Department of Justice closed its crypto enforcement unit, which raised concerns about regulatory oversight in the crypto space. Additionally, the SEC approved ETH ETF options, marking a significant development for Ethereum.

Market Resilience: Despite the volatility caused by tariff news, the crypto market demonstrated resilience, with Bitcoin's performance sparking debates about its role as a safe haven versus a risk asset. Analysts noted that Bitcoin's recovery indicated its potential as a hedge against inflation and economic uncertainty.

Looking Ahead

As we look ahead to the next week, several key economic and crypto developments are anticipated:

SorooshX Updates

SorooshX weekly stars in Ideas introduced:

Checkout last week's Top 5 spot trades closed with highest profits

1) $RAREUSDT BUY +11.94%

2) $POLUSDT SELL +9.84%

3) $SUSDT SELL +9.63%

4) $TONUSDT SELL +8.38%

5) $BTCUSDT SELL +6.82%

We are also excited to announce the listing of trending trading pairs on our platform (Spot and Futures) during the last week:

Our recent listing ($RFC) surged up 1400% since getting listed on SorooshX

We also released an important notice:

Attention Dear SorooshX Users

- The financial social network “Ideas” has been designed to enhance knowledge and facilitate the sharing of useful and practical data, including news, signals, live trades, and in future versions, educational videos.

- Our goal is to protect the security and assets of our users and to educate them on this platform with valuable and organized content—away from unreliable Telegram and Instagram channels and pages. Therefore, any content promoting Telegram channels, etc., will be reported by other users and SorooshX bots.

- By creating quality content and offering valuable services to users, you can launch your VIP channels and daily live trades on Ideas and generate significant income through its monetization system.

- Focus on growing your page on Ideas, and in the near future, you can own a reliable and scalable business within this smart ecosystem.

Thank you for being a part of the SorooshX community! Stay informed and make the most of your trading experience on SorooshX! Here’s how you can engage with us:

Explore New Features: Log in to your SorooshX account to experience the latest updates and improvements.

Join the Conversation: Join “Ideas” our special social media for traders on SorooshX to stay updated on market trends and platform news.

Trade Smart: Take advantage of our newly listed trading pairs and explore new opportunities in the market.