home

blog

sorooshx-weekly-updates

SorooshX...SorooshX Weekly Update (April 13th-19th): Market Insights and Platform updates

- Bitcoin Price Movements: Bitcoin (BTC) experienced significant fluctuations last week, trading between $83,000 and $86,500. The price rose by 1.44% in a 24-hour period, reflecting a bullish sentiment among traders as the week progressed. Analysts noted that if Bitcoin can maintain its position above $88,000, it could potentially test the $90,000 mark in the near future.

The market sentiment was influenced by macroeconomic factors, including concerns about inflation and the Federal Reserve's monetary policy. The Fed's decision to maintain interest rates has contributed to a more stable environment for risk assets, including cryptocurrencies.

- Ethereum's Continued Development: Ethereum remains a focal point in the crypto space as it continues to evolve with upgrades aimed at enhancing scalability and reducing energy consumption. These developments are expected to attract more institutional investors, further legitimizing Ethereum as a key player in the digital asset market.

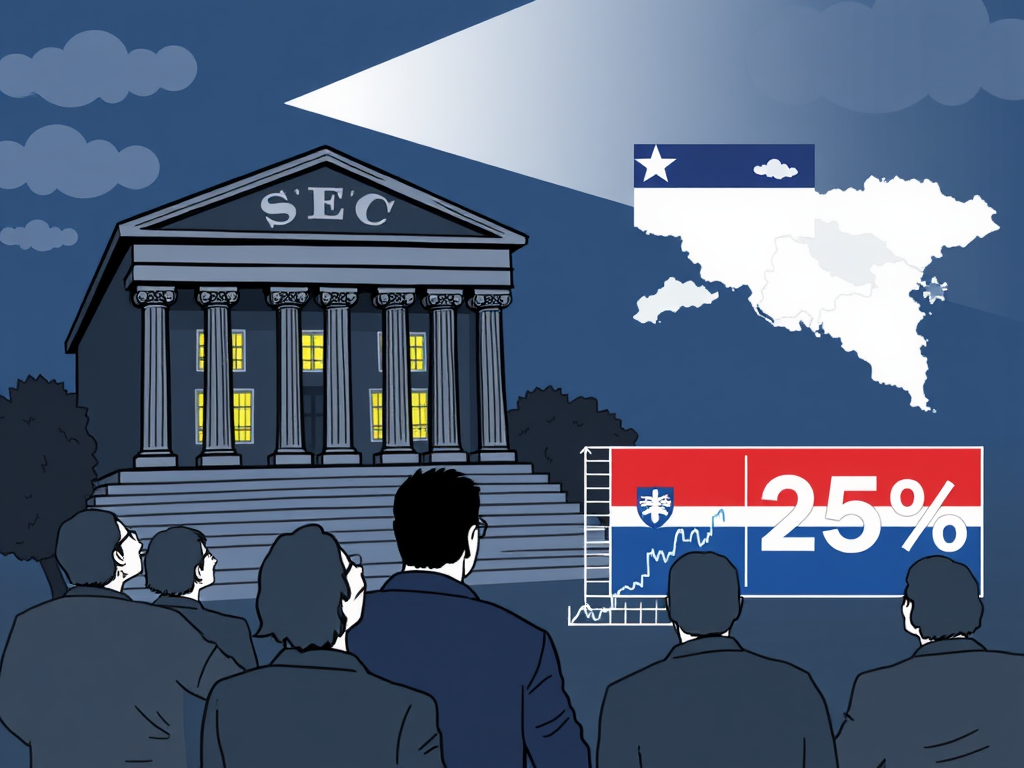

- Regulatory Developments: The U.S. Securities and Exchange Commission (SEC) has intensified its scrutiny of cryptocurrency exchanges, leading to enforcement actions against several platforms for failing to register as securities exchanges. This regulatory pressure has raised concerns among investors about the future of crypto trading in the U.S. and could lead to increased volatility in the market.

Additionally, Slovenia has announced plans to tax crypto profits at a rate of 25%, which will apply to profits from selling cryptocurrencies for fiat currency or goods and services, but not for swapping one cryptocurrency for another. This move reflects a growing trend among governments to regulate and tax digital assets

- Market Capitalization Trends: As of mid-April 2025, the total cryptocurrency market capitalization was approximately $2.76 trillion, indicating a recovery from previous downturns. This resurgence is largely driven by increased adoption and investment in digital assets, particularly among younger demographics who are more inclined to explore cryptocurrencies as an investment option.

- Institutional Interest: Reports indicate a growing interest from institutional investors in cryptocurrencies, particularly Bitcoin and Ethereum. This trend is seen as a positive sign for the market, suggesting that digital assets are increasingly being viewed as a legitimate asset class. Institutional investment could provide the necessary liquidity and stability to the market.

Looking Ahead

As we look ahead to the next week, several key economic and crypto developments are anticipated:

Economic Indicators: Investors will be closely monitoring upcoming economic reports, including inflation data and employment figures. These indicators could significantly impact market sentiment and lead to further volatility in cryptocurrency prices. A higher-than-expected inflation rate could prompt concerns about interest rate hikes, affecting risk assets like cryptocurrencies.

Regulatory Clarity: Continued developments in regulatory frameworks, particularly in the U.S. and Europe, may provide clearer guidelines for crypto exchanges and investors. Positive regulatory news could bolster market confidence and encourage more participants to enter the market.

Technological Advancements: As Ethereum and other blockchain networks roll out new features and improvements, the market may react positively to advancements that enhance usability and security. Innovations in decentralized finance (DeFi) and non-fungible tokens (NFTs) could also drive interest and investment.

Market Sentiment: Overall market sentiment remains cautiously optimistic, but traders should remain vigilant of potential corrections, especially if Bitcoin's price approaches critical resistance levels. The interplay between macroeconomic factors and crypto-specific developments will be crucial in determining market direction.

As a result, while the crypto market shows signs of recovery and increasing institutional interest, external economic factors and regulatory developments will play crucial roles in shaping market dynamics in the coming week.

SorooshX Updates

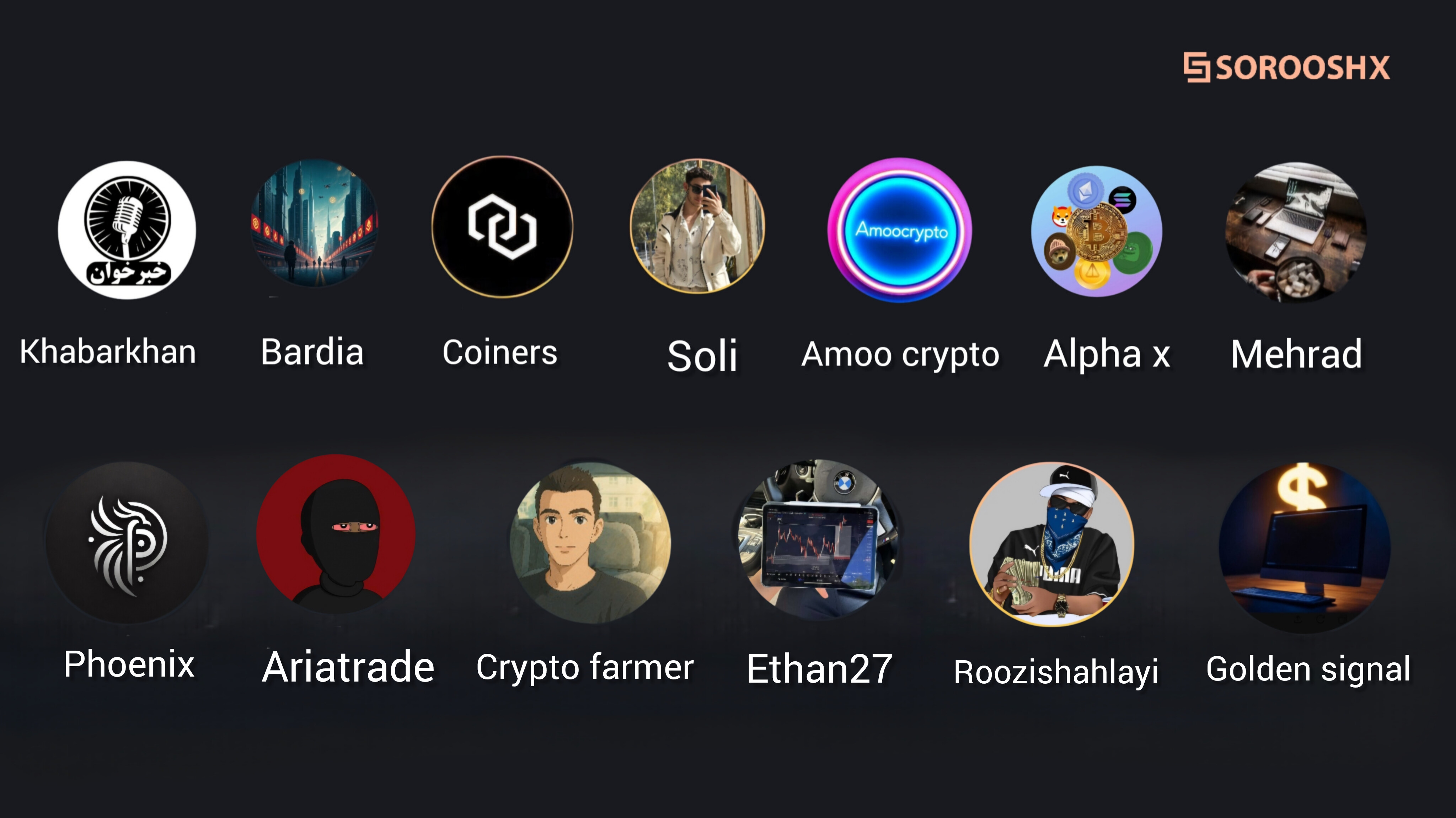

SorooshX’s best channels of the month in Ideas introduced. This rating is based on activity, Xscore, and popularity of the channel.

$10 bonuses winner channels:

1) Khabarkhan

2) bardia_ai

3) coiners

4) soli_crypto

5) amoo_crypto

6) phoenix

7) mehrad_ch

$5 bonuses winner channels:

8) ethan27

9) ariatrade

10) dex_ideas

11) roozishahlayi

12) golden_signal

13) alphax_crypto_fx

We are also excited to announce the listing of trending trading pairs on our platform (Spot and Futures) during the last week:

Thank you for being a part of the SorooshX community! Stay informed and make the most of your trading experience on SorooshX! Here’s how you can engage with us: